Operational Risk Management in a Period of Disruption – Will Normal Programming Resume Shortly?

In both normal times and uncertain times, policies and procedures seek to give all employees support in the carriage of business activities.

In both normal times and uncertain times, policies and procedures seek to give all employees support in the carriage of business activities.

The Latest GRC Asia report: Online Learning takes off / Consumption-Based Emissions / Latest version of Salt Compliance LMS

A moment of complacency, a daydream, or a (well-put-together) phishing email is all it takes for hackers to bypass even the most vigilant staff in your organisation.

In this article, Thomas Fox, Compliance Evangelist based in Houston, TX, addresses the question, “What if you want to take your post-training analysis to a higher level and begin a more robust consideration of the effectiveness of compliance training?”

“Everyone can benefit from Risk Management training.”

Alf Esteban, Protecht

We are pleased to offer Protecht’s popular Introduction to Risk Management course. This course introduces the concept and nature of risk as it relates to a range of organisations using a variety of concepts to aid topic understanding.

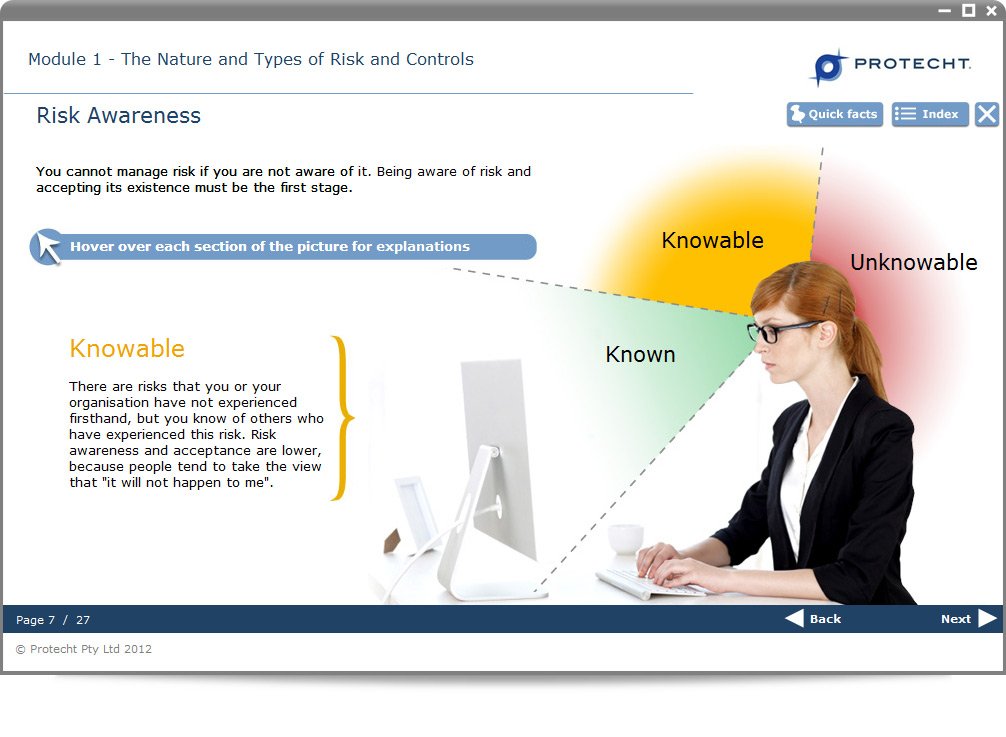

Chapter 1 identifies the nature and behaviour of risk and explores concepts such as Risk Awareness, Risk Acceptance and the risk lifecycle. It describes how different types of controls minimise risk, and considers the types of risks usually faced by financial institutions.

Chapter 2 considers the aims, objectives and key components of the Risk Management process within an organisation. It expands on the concept of the risk lifecycle, as illustrated by a Risk Funnel chart. It explains the 3 Lines of Defence Model and the various Risk Management Standards and methodologies used globally.

Chapter 3 explores the Risk Management process as defined by ISO 31000 and AU/NZS, and explains how Risk Management tools apply to business processes.

This training is suitable for those seeking an introduction to the field of risk management and those who need to have a broad understanding of risk management.

Module 1 : The nature and types of risk

Module 2 : Risk Management, Frameworks and Standards

Module 3 : The Risk Management Process

As we head into the silly season, it’s worth keeping in mind that silliness is no excuse for poor standards of behaviour or even misconduct at work functions.

This training is for banking staff on how to avoid dealing with sanctioned countries, businesses and persons

There are severe penalties for banks that commit OFAC violations. Staff need to understand how the OFAC works and how to avoid committing violations.

This short, single-module course gives an overview of OFAC, is functions and how it works. The training provides an overview of the Sanctions List and the sorts of individuals and entities that may be included in it.

Learners are introduced to the compliance obligations that OFAC imposes on banks and given information on how they, personally, should act to support the bank in meeting those obligations. The penalties for non-compliance are discussed.

The course is a suitable introduction for all banking staff who on-board customers or who handle customer transactions.

Jasmine is an executive officer at My Save Bank, which has its head office in Ohio. While undertaking an audit of pending transactions, she discovers a number of large sums of money being transferred to a foreign national in Yemen. Jasmine is concerned that the account name and details look suspicious and are not what My Save Bank would typically deal with.

What should Jasmine do next?

This course is part of the Retail Banking Compliance Suite

The courses available are

For more details, click on the course names above.

Trade is not without risk for buyers and sellers, and international trade has certain features that enhance that risk.

In a globally interconnected world trade has become a part of our daily lives. This prominent feature of the global economy has developed and matured over hundreds of years and is a tribute to human ingenuity to cooperate for mutual benefit. However, trade is not without risk for buyers or sellers and international trade has certain features that enhance that risk. Banks have traditionally played a crucial role as facilitators to mitigate the risks inherent to international trade. This training will review features of international trade, focus on the financing of trade and in particular on the role that banks play.

The Introduction to Trade Finance e-learning course has especially been designed by subject matter experts to provide banking professionals with an overview of Trade Finance and the role of Financial Institutions.

On completion of the course you will have developed a good foundational understanding of global trade and how companies settle their international commerce. Therefore this course, in combination with i-KYC’s TBML course, will also be valuable for learners who are still developing their technical Trade Finance knowledge.

This course is suitable for:

Download the course outline here

GRC Solutions is thrilled to collaborate with leading financial crime advisory firm, i-KYC, pairing their premium content library with our award-winning Salt Learning technologies to improve your approach to addressing Financial Economic Crime (FEC).

Download our brochure here

Module 1: Introduction

Module 2: Trade Settlement Methods

Module 3: Risks & Roles of Banks

Module 4: Knowledge Check

On 12 September, for the first time since 2017, new Global Estimates of Modern Slavery will be announced.

In 2024, businesses and financial institutions are expected to embrace ESG criteria not just for compliance or risk management, but as a chance to fundamentally transform their business models to become more sustainable and increasingly more transparent

Give us a call or complete the form and we’ll be in touch soon

Level 14-01,

1 Wallich Street, Guoco Tower

Singapore 078881

+65 6403 3830

Level 14, 201 Kent Street

Sydney NSW 2000 Australia

+61 2 8823 4100

+61 2 8823 4104

Better (US) Inc

101 S. Reid St Suite 307 PMB# 1274

Sioux Falls, SD 57103.