Introduction to Risk Management

Course Description

“Everyone can benefit from Risk Management training.”

Alf Esteban, Protecht

We are pleased to offer Protecht’s popular Introduction to Risk Management course. This course introduces the concept and nature of risk as it relates to a range of organisations using a variety of concepts to aid topic understanding.

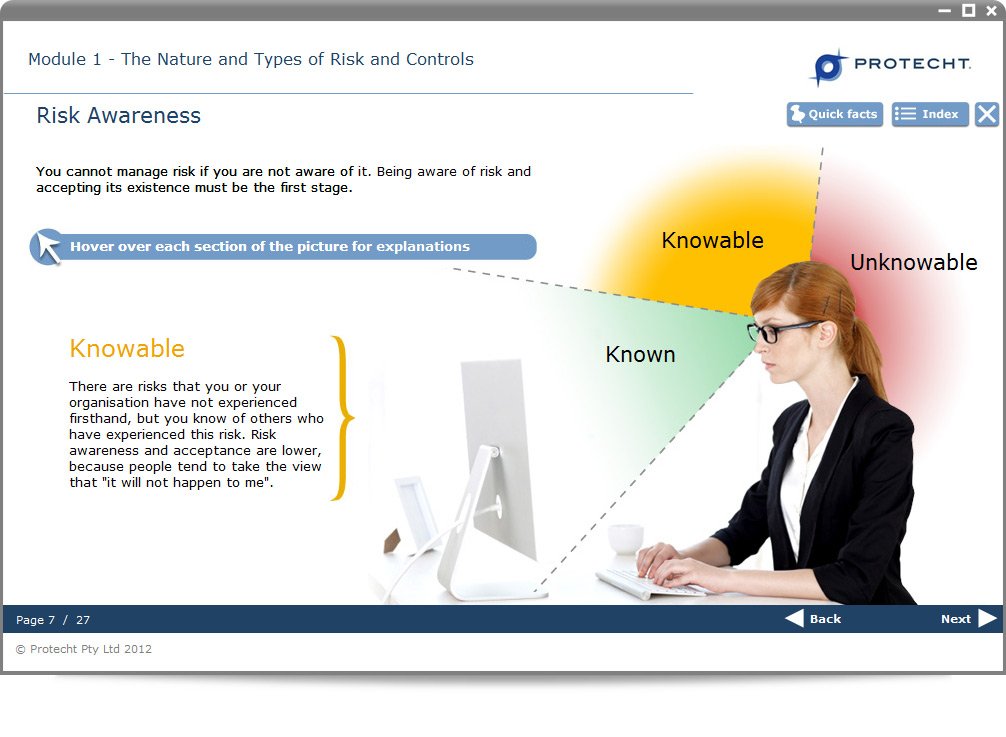

Chapter 1 identifies the nature and behaviour of risk and explores concepts such as Risk Awareness, Risk Acceptance and the risk lifecycle. It describes how different types of controls minimise risk, and considers the types of risks usually faced by financial institutions.

Chapter 2 considers the aims, objectives and key components of the Risk Management process within an organisation. It expands on the concept of the risk lifecycle, as illustrated by a Risk Funnel chart. It explains the 3 Lines of Defence Model and the various Risk Management Standards and methodologies used globally.

Chapter 3 explores the Risk Management process as defined by ISO 31000 and AU/NZS, and explains how Risk Management tools apply to business processes.

WHO IS THIS TRAINING FOR?

This training is suitable for those seeking an introduction to the field of risk management and those who need to have a broad understanding of risk management.

Course Outline

Module 1 : The nature and types of risk

Module 2 : Risk Management, Frameworks and Standards

Module 3 : The Risk Management Process